August was a tough month for stocks, with the major benchmark indexes ending the month lower. Investors tried to decipher mixed economic data throughout the month, vacillating from a just-right mix of growth, employment, and receding inflation (aka “Goldilocks economy” in July) to a looming recession in August. The Federal Reserve and its interest rate policy are still central to the swings in sentiment.

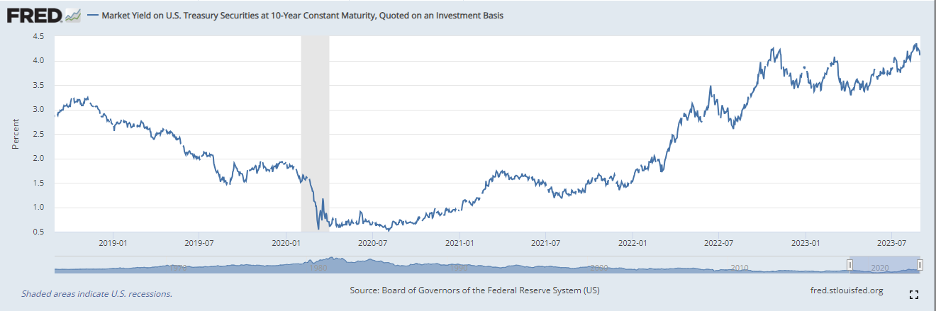

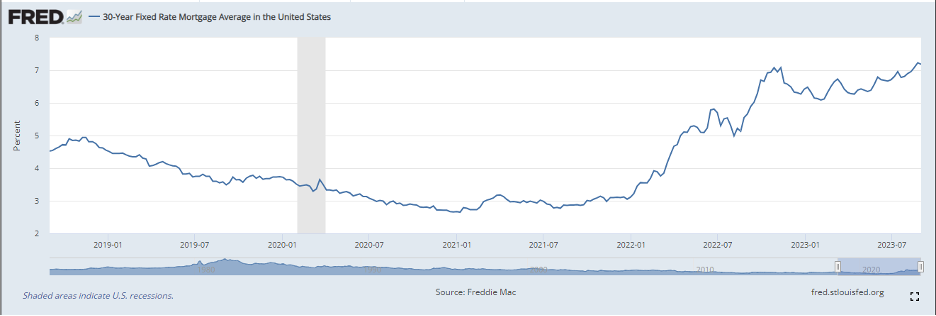

In early August, a shift in the financial landscape disrupted the positive mood that had prevailed in July. This change was triggered by rating agency downgrades and the U.S. Treasury’s revealing its plan to issue more bonds than expected to pay for spending. As a result, the stock market’s upward momentum corrected, and the yield on ten-year U.S. Treasury bonds rose above 4%. This increase in Treasury yields also increased the 30-year mortgage rate to over 7%.

The catalyst for these financial developments can be traced back to August 1st when Fitch Ratings downgraded the United States’ long-term foreign-currency issuer default rating due to concerns about governance and the country’s growing debt burden. The following day, on August 2nd, the Treasury Department announced a quarterly funding plan that revealed more bond issuance than expected to cover government expenses. The increased supply of bonds caused bond prices to fall, resulting in higher yields.

The combination of high levels of debt and deficits and the rising cost of servicing this debt due to higher interest rates continues to be a topic of concern and discussion. However, meaningful actions to address these issues have been limited. Given that it’s an election year, we can expect this topic to gain even more attention in the coming months.

During the final week of August, the Federal Reserve provided an updated outlook, which boosted market confidence. Softening labor market data bolstered the view that the Fed’s rate hike cycle is nearing its end. This news partially reversed the earlier correction in the stock market and the rise in Treasury yields during the month.

At the Annual Economic Symposium in Jackson Hole, Fed Chair Jerome Powell presented his speech titled “Inflation: Progress and the Path Ahead.” In his address, Powell reaffirmed the Fed’s commitment to achieving 2% inflation in the economy. However, he balanced this commitment by acknowledging the significant interest rate hikes implemented since early 2022, the decrease in inflation observed so far, and a cautious approach guided by incoming data. This suggests that most of the Fed’s rate hikes have already occurred, and future rate increases will be slower or possibly halted, depending on economic indicators.

In his conclusion, Powell seemed to request understanding from his audience, given the reliance on imperfect data, describing the Fed’s decision-making process as “navigating by the stars under cloudy skies.” This metaphor extends to the challenges faced by business leaders and investors in predicting the direction of the economy and financial markets. Many uncertainties result from public policy decisions, which some may argue were misguided. These include the federal government’s debt accumulation and the Federal Reserve’s manipulation of market interest rates in response to the financial crisis and the pandemic.

The Federal Reserve’s primary responsibilities include managing national monetary policy, supervising and regulating banks, ensuring financial stability, and offering banking services. The Federal Open Market Committee determines U.S. monetary policy based on its mandate from Congress to promote maximum employment, stable prices, and moderate long-term interest rates.

As discussed in a March 2023 blog, regional and community banks have faced financial challenges. Their financial health was affected by the influx of cash during the pandemic when the economy came to a standstill and interest rates were low. Then, as the Fed rapidly ratcheted rates, deposits flowed out as customers sought higher yields on short-term treasuries and money market instruments, investing in high-quality, short-term assets. So far, in 2023, there have been three notable bank failures. We don’t know if there will be more, but bank earnings and balance sheets are still challenged. And in August, rating agencies like Moody’s and S&P began reflecting the reality facing regional and smaller banks by downgrading their outlook. Credit conditions have tightened as banks have raised rates and tightened lending standards. Powell’s Jackson Hole speech on August 25th acknowledged this: “Beyond changes in interest rates, bank lending standards have tightened, and loan growth has slowed sharply. Such a tightening of broad financial conditions typically contributes to a slowing in the growth of economic activity, and there is evidence of that in this cycle as well.”

The good news is that inflation has receded. Whether it arrives at the Fed’s 2% target or the Fed accepts a slightly higher rate is to be seen. In addition, the consumer drives the economy, and consumers have a lot going for them. A resilient labor market, though showing signs of cooling, means most people who want to work can find jobs. The percentage of consumer income consumed by mortgage payments is historically low. Homeowners locked in mortgage rates before the recent rise and are sitting tight, reducing the supply of existing homes available. And while existing homes’ sale prices declined, sales of new homes advanced, and new home sale prices increased.

Regardless of the outcome, a Goldilocks economy or a recessionary period, we remain committed to staying focused on what we can control. It is imperative to have a plan that aligns your portfolio with your goals and risk tolerance, so please talk to us if you’ve any concerns. Despite the short-term volatility and the risk detailed above, stocks and bonds can provide attractive returns to those with a long-term mindset. Volatile times make it even more critical that your portfolio is aligned with your goals, so please talk to us if you’ve any concerns.

Your August portfolio reports have been posted in your eMoney vault, and as summer winds down, we will be reaching out in the coming days to schedule reviews. If you would like to discuss your portfolio or review your financial plan sooner, please reach out or schedule a virtual or in-person meeting.

Thank you for your continued trust and confidence.

Tim

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward-looking and should not be viewed as an indication of future results.