Thursday morning Russia expanded military operations in Ukraine unsettling investment markets. Thus far, equity markets have remained relatively orderly amidst the fluid situation. Unfortunately, the Ukrainians appear to be in for harrowing times and our thoughts are with them.

Kara Murphy, CFA® recently joined Kestra Investment Management as Chief Investment Officer. In addition to being an accomplished investment professional, early in her career, Kara was a political and economic analyst covering Eastern Europe and Russia. Consider her video for perspective on Putin’s motivations, tactics, the role oil production and higher oil prices plays.

When facing emotional market disruptions, such as geopolitical tensions, it is important to stay grounded in your long-term goals. Each crisis, from geopolitical risks to changes in monetary policy, can feel daunting. But rather than trying to predict what happens next, it’s critical to: 1) keep things in historical perspective and 2) stay disciplined.

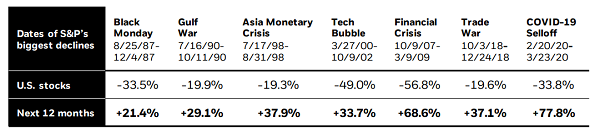

The table below illustrates the resilience of stock market returns just 12 months after a major selloff.

Source: Morningstar as of 12/31/21. Returns are principal only not including dividends. U.S. stocks represented by the S&P 500 Index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You can’t invest directly in an index.