At the opening of March, the Russian invasion of Ukraine was just a few days old. The civilian population of Ukraine has been brutalized. The humanitarian crisis is wrenching. Ukraine’s military resistance has been stiff, and as we close out March, the capital city and much of Western Ukraine are still under Ukrainian control. The civilized world has lined up in support of Ukraine and, short of military intervention, has opposed Putin, casting him as a pariah. Ukraine’s allies are watching carefully, concerned about the potential use of non-conventional warfare and skeptical about the validity of Russia’s words of negotiation, most often discounted as a ploy or propaganda.

It is hard to judge how the conflict ends. The economic repercussion appears to be higher energy and commodity prices transmitting another global inflationary supply shock, adding another level of complexity to the Federal Reserve’s task of dampening inflation.

During March, jobs reports continue to come in strongly, with the headline unemployment rate falling to 3.8%. Inflation readings continue to come in hot as well. Mid-March brought a rally in equities recovering a portion of its year-to-date losses. The forces underneath the market recovery were the expected tightening from the Fed (only 25 basis points) accompanied by hawkish language. Secondly, the Russian advance into Ukraine appeared to be stalling and not widening. The market cheered as the Federal Reserve gained credibility that it will act quickly and effectively to tighten and dampen inflation.

The last time the Federal Reserve dealt with a severe inflation problem was in the 1970s. Some of you may remember Pres. Gerald R Ford’s Whip Inflation Now (WIN) initiative. Circumstances then are different than now. In the 70s, the OPEC oil embargo dramatically increased the cost of energy and resulted in a recession, accompanied by high unemployment and a stagnating economy. Today, the energy cost is increasing; however, the economy is expanding, and the labor markets are robust with low unemployment.

We hosted a call with economist Barry Knapp on March 10. Barry provided insights into the current economic conditions and the impact of the inflationary shocks that have brought the economy to its current state. If you didn’t get to make the call, I encourage you to review our blog posting, which provides an executive summary of Knapp’s comments and key video clips.

You may hear financial pundits cite a flattening yield curve as a signal of concerns for economic growth going forward. The economists we follow and Fed Chief Powell have said the risk of recession over the next year “is not particularly elevated.” Knapp and others dismiss the notion that the economy is destined for 70’s stagflation and that higher oil prices mean slower growth to the point of recession. Seigel points out the U.S. is much less dependent on foreign oil than in the ’70s. During our discussion with Knapp, he noted that the U.S. dollar has become and performed as a “Petro Dollar.” However, the U.S. has a fundamental inflation problem much bigger than the risk of recession, and the Fed needs to administer “the medicine” to slow inflation.

If you are interested in monetary policy, I came across this excellent Investors Business Daily (IBD) article explaining the State of Monetary Policy.

We expect market turbulence as geopolitical events evolve and the Federal Reserve takes measures to dampen inflation. Bond returns will very likely continue to be challenged. We will stay focused on what we can control and remain committed to investment strategies informed by your financial plan and well-diversified, cost-effective, and tax-conscious portfolios.

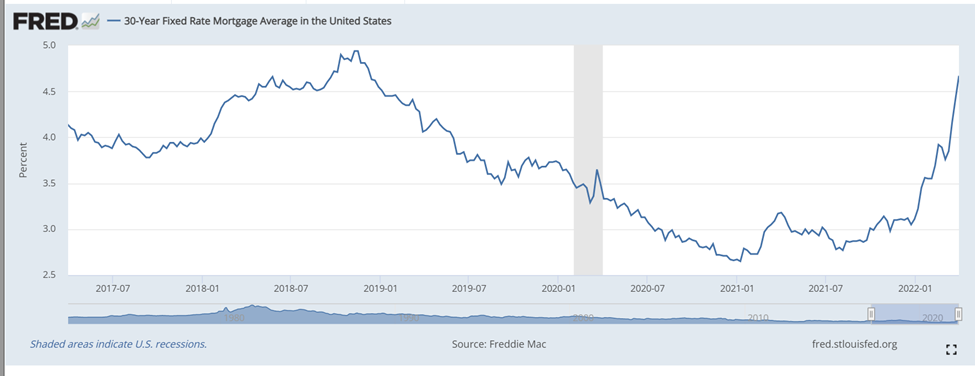

Finally, you may have friends or family impacted by the red-hot residential home market or increasing rents. 60 minutes ran a story on Sunday, March 20, 2022, about first-time homebuyers being driven out of the residential home market by large financial institutions buying residential homes for rentals. The institutional buyers are hard to compete with; they are cash buyers that will buy properties sight unseen. Fortunately, the Fed’s action may help drive these institutional buyers out of the market, and though they will need to cope with higher mortgage rates, first-time homebuyers may get a better shot at finding a home of their own. If you refinanced at a 3% or lower rate, pat yourself on the back! However, as the graph shows below, the 30-year mortgage rate is approaching 5%.

Your March reports have been deposited into your eMoney vault, and we will be reaching out to you to offer times and availability for revies, or you may self-schedule here to pick a convenient time for you.

Thank you for the trust you place in us! We look forward to connecting soon!