Stocks performed well in July, as major benchmark indexes recorded significant gains. Despite the interest rate rise, the stock market and the economy have shown resilience throughout 2023. Concerns about inflation, economic growth, the U.S. banking system, and the Federal Reserve’s rate hikes have diminished recently. Contrary to concerns about an inevitable recession, recent data from July has shifted sentiment towards the possibility of a softer landing facilitated by the Federal Reserve.

To gain ground on reducing inflation to the government’s target of 2.0%, the Federal Reserve raised the federal funds rates by another 25 basis points in July, bringing them to the highest level in 22 years. Regardless of the efficacy of the Federal Reserve’s policy decisions, signs indicate that inflation is subsiding. Both the Consumer Price Index and the personal consumption expenditures price index experienced their lowest 12-month rates in almost two years. Import and export prices, as well as producer prices, declined in July. On the other hand, the gross domestic product, which accelerated in the second quarter and has continued to grow since Q2 2022, surpassed expectations. This blend of lower-than-expected inflation and stronger-than-expected growth is promising.

U.S. consumers have displayed resilience despite the Federal Reserve’s efforts to slow down the economy. Consumer spending, a key indicator of economic growth, continued to rise, albeit slower than earlier in the year. Employment remained robust, with over 200,000 new jobs added, while the unemployment rate rested at 3.6%. Wages also increased by almost 4.5% over the last year. Although unemployment claims have risen from the previous year, they remain far below the peak figures observed during the height of the COVID pandemic.

While many economic indicators demonstrated strength in the past month, certain sectors experienced setbacks. The housing market, for instance, declined due to a shortage of inventory and rising mortgage rates. Sales of new and existing homes struggled, although home prices remained strong.

With the economy maintaining its strength, the stock market also performed admirably. Both the S&P 500 (1) and the Nasdaq (2) achieved five consecutive months of gains, marking their best seven-month start to a year since 1997. In July, the Dow (3) experienced a streak of 13 consecutive sessions with gains, resulting in a 3.35% increase for the month. However, its year-to-date growth of 7.28% paled compared to the Nasdaq’s remarkable 37.0% increase and the S&P 500’s 19.0% rise.

Throughout July, all market sectors advanced. Notable outperformers included energy (8.0%), communication services (7.8%), financials (5.7%), and materials (4.0%), indicating a broad market recovery that extended beyond the dominant mega-cap tech stocks.

Back to Bonds

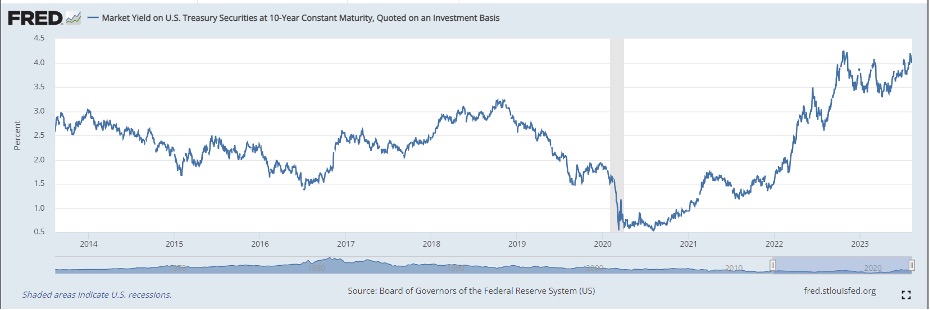

The substantial monetary and fiscal stimulus implemented during the pandemic period led to a surge in the money supply, serving as an indication of substantial forthcoming inflation. This situation concurrently drove yields on bonds to historically low levels, thereby introducing the risk that a swift increase in rates could swiftly diminish bond prices. As a response to this scenario, we made the decision to decrease our investment in bonds and shorten the combined duration of our bond holdings.

In the year 2022, the Federal Reserve adopted a swift and substantial policy of raising interest rates, resulting in one of the most unfavorable bond markets in history. This policy had far-reaching effects, including impairing the financial health of many banks through impacts on their balance sheets and income statements.

With the current trend of diminishing inflation and indications that the Federal Reserve has concluded its cycle of rate hikes, all while bond yields stand at levels higher than their pre-pandemic figures, we are adjusting our bond utilization and allocation strategy within portfolios.

Traditionally, bonds have been regarded as the unassuming asset class, offering modest returns, low volatility, and a low correlation to stocks. This quality makes them a stabilizing and diversifying force within a portfolio. We’re gradually transitioning back to a standard bond allocation within our portfolios and concurrently augmenting the duration of our bond holdings.

In the realm of bond investing, duration denotes a measure of how responsive a bond’s price is to shifts in interest rates. This concept is pivotal because it grants investors insight into the potential price fluctuations a bond might experience due to changes in interest rates. In simpler terms, duration quantifies the vulnerability of a bond to interest rate changes.

Predicting the future trajectory of interest rates is infamously challenging. However, if the delayed impacts of Federal Reserve monetary policy, including challenges to bank financials, hindrances for smaller businesses, and pressures on commercial real estate financing, result in an economic downturn, the Fed could move closer to a shift. This shift might encompass not just avoiding rate hikes but potentially even lowering rates. For investors holding longer-duration bonds, this would represent a favorable development.

Although the persistence of inflation and the unfinished work of the Fed remain possibilities, any further rate hikes are likely to be incremental. The most substantial rate increases are possibly already in the past. Since bond yields have risen, taking on some duration risk is less hazardous compared to when bond yields were forced to historic lows during the era of the Fed’s zero interest rate policy. If rates rise, the bond’s value might decrease, but the higher yield it provides could offset this decline.

In early August, certain events impacted the equity rally and drove up U.S. Treasury yields. On August 1st, Fitch Ratings lowered the long-term foreign-currency issuer default rating for the United States, citing concerns about governance and the nation’s escalating debt burden. Following this, on August 2nd, the Treasury Department unveiled a quarterly refunding plan that involved issuing more bonds than initially anticipated to cover government expenditures. The influx of additional supply into the bond market drove down bond prices, leading to higher yields. Consequently, the ten-year Treasury yield surpassed 4%. The scale of debt and deficits, coupled with the mounting cost of servicing this debt at elevated interest rates, remains an ongoing concern that garners much discussion but sees limited action.

Your July portfolio reports have been posted in your eMoney vault, and as summer winds down, we will be reaching out in the coming days to schedule reviews. If you would like to discuss your portfolio or review your financial plan sooner, please reach out or schedule a virtual or in-person meeting.

Thank you for your continued trust and confidence.

Tim

- S&P 500 Index – The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

- NASDAQ – The NASDAQ) is an unmanaged group of securities considered to be representative of the stock market in general.

- Dow – The Dow Jones Industrial Average (DJIA) is an unmanaged group of securities considered to be representative of the stock market in general.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward-looking and should not be viewed as an indication of future results.