This past week, a couple of high-profile CEOs issued ominous warnings about economic conditions ahead. Jamie Dimon, CEO of J.P. Morgan Chase, warned at an investor conference, “A hurricane is right out there down the road coming our way…brace yourself.” In his usual Twitter speak way, Elon Musk, CEO of Tesla, said, “I have a super bad feeling about the economy.” These high-profile views capture the mood of the market.

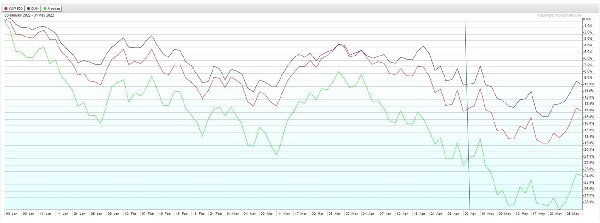

The major stock index averages sank to new 2022 lows in mid-May. Yet, the Dow Jones Industrial Average (DJIA) (1) and S&P 500 (2) managed to stay in correction territory by not dipping more than 20% below recent highs. The NASDAQ (3) etched new bear market lows. However, in the waning days of May, the DJIA and the S&P 500 regained enough ground to end the month at approximately where they began in May. The NASDAQ also regained ground but fell short of achieving the level at which it entered the month.

News media is filled with stories about the contributors to the dour mood of the quoted CEOs and the market in general. The word salad graphic above may capture how you feel as you try to get your head around the consensus view that inflation and the Federal Reserve’s response to inflation will result in recession and shipwreck the investment markets.

There are a multitude of factors that impact the economy and investment markets. At the risk of oversimplifying, higher inflation resulted from the historic amount of stimulus applied to prop up an economy shut down due to the pandemic. The Federal Reserve is reversing policy to tighten economic conditions and slow the economy to reduce inflation. The Federal Reserve’s primary policy tools result in higher interest rates. The Fed can increase the federal funds rate, which influences short-term rates. And this month, the Fed begins “quantitative tightening,” which is the esoteric term meaning that rather than buying government bonds and mortgages to keep interest rates low, the Fed becomes a net seller increasing long-term interest rates. Higher rates mean a higher cost of borrowing for businesses investing in their operations and for consumers who borrow for housing and durable goods purchases.

Other compounding factors include a tight labor market and shocks to the energy markets. Presently, demand for labor outstrips the supply of labor. An excess of over five million job postings to workers looking for jobs contributes to upward wage pressure. In addition, energy prices have increased significantly due to the increasing demand of post-pandemic reopening economies and a reduction in energy supply, with the most significant recent shock being the war in Ukraine.

A slower economy transmits to lower corporate earnings and ultimately less demand for workers in the job market. Workers whose wages are declining or, at the extreme, who are unemployed spend less which cools inflation. Investors anticipating that Federal Reserve actions will stall the economy and thus cause a recession makes them bearish. The stock market is widely considered a leading indicator of future economic conditions.

Based on the media vibe and stock market, one might conclude that recession is inevitable. That seems to be where most people’s heads are in conversations with clients. But if this recession occurs, when will it occur, and how severe will it be? The possible outcomes from best to worst are:

- the Federal Reserve engineers a “soft landing” (no recession)

- a recession occurs later (beyond 18 months) and is mild

- a recession occurs sooner and is mild

- a recession occurs sooner and is severe.

In evaluating these possible outcomes, I harken to investment sage Jeremy Seigel. In a May 2, 2022 commentary, he wrote: “I emphasize again that I do not see a recession this year. If we do get one, I will remind investors: a recession impacts earnings for one year or two. Stocks are the present value of discounted cash flows long into the future. Stocks over-react negatively during these earnings drawdowns when less than 5% of the value of a stock would come from this year’s earnings. Try to keep the long view as you hear increasing talks of the Fed causing a recession.”

Yes, uncertainty about the course of inflation, Fed policy, and the economy, in general, has raised the risk of recession. However, the nightly news will likely leave you with the impression that the U.S. economy entering a recession soon is a foregone conclusion. I do not believe it is.

I went to the archives to research some quips about recessions. One is attributed to renowned economist Paul Samuelson who in 1966 wrote that the stock market has correctly predicted five of the last nine recessions. Another quip that came to mind is, “a recession is when your neighbor loses his job, and a depression is when you lose your job.”

In 2016, CNBC did an article on Paul Samuelson’s observation about bear markets and recessions. As it turns out, whether a bear market precedes a recession has about the same probability as a coin toss. It is interesting to note that in 2016 there was a correction, but neither a bear market nor a recession followed.

Recessions are an inevitable part of the economic cycle. However, no one can predict either the magnitude or timing of a recession. Successful investors accept recessions as inevitable and stay focused on what they can control. Investors can control staying committed to their long-term investment discipline. They can also take actions that may feel uncomfortable but position them for long-term success.

If the recent market correction concerns you, don’t assume a short-term drawdown of your financial accounts will knock your retirement plan off track. Instead, let us revisit your financial plan and review your portfolio with you. Doing so can help you reframe your unique personal financial goals and circumstances into a long-term view. It is the best way to assess the impact of market changes upon achieving your goals and provides a framework to consider corrective actions if warranted.

Take solace in the knowledge, supported by historical fact, that lower stock prices mean lower stock valuations and higher future returns on your investment. This may be the right time to gradually invest cash on hand so that you can commit to long-term investments. Other actions that may be appropriate are to consider maxing out retirement plan contributions or doing a Roth conversion.

Market drawdowns can be viewed as an opportunity to do a Roth conversion of some or all of a traditional IRA account. Transferring long-term investments that have drawn down in value reduces the current tax due and can magnify the future amount of capital in a Roth IRA with tax-free distributions. We are here to evaluate whether a Roth conversion might be appropriate for you.

We are reviewing portfolios and rebalancing to lean into the investment types and sectors which we believe are best suited for the economic and market situation as it stands today. In addition, for taxable accounts, we are looking for opportunities to harvest losses as we reposition.

We can’t tell you when things will turn or by how much, but we expect that investors bearing today’s risk will be compensated with positive long-term returns. Additionally, history has shown no reliable way to identify a market peak or bottom. These beliefs argue against making market moves based on fear or speculation and support commitment to planning, diversification, rebalancing, and tax-loss harvesting.

There may be several merit-worthy moves to make during a market drawdown. Still, it will never be taking sweeping bets, deviating dramatically from a plan, or believing that the fundamental rules of investing don’t apply to you. Markets can be volatile and punishing on any given week, month, or even year. But, over an investment lifetime, they have consistently rewarded those who patiently and calmly diversify, simplify, and focus on goals and that which they can control. Now is the time to remain disciplined and committed to your long-term investment strategy.

We are here to help! If you would like to discuss the state of the economy and markets or review your financial plan and portfolio, I encourage you to schedule a virtual or in-person meeting. My mobile phone number is 817-271-0654, and you are welcome to call after hours if that works better for you.

Many thanks,

Tim

_________________________________________________________________________

1. The Dow Jones Industrial Average is an unmanaged group of securities considered to be representative of the stock market in general.

2. The S&P 500 is an unmanaged group of securities considered to be representative of the stock market in general.

3. The NASDAQ is an unmanaged group of securities considered to be representative of the stock market in general.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward-looking and should not be viewed as an indication of future results.