Takeaways

· The U.S. economy continued to show resilience despite elevated inflation and high interest rates, dampening expectations of interest-rate cuts

· The broad stock market gained more than 10%, its best start to the year since 2019.

· All but one S&P 500 sector saw positive returns, a sign of healthier levels of market breadth than in 2023.

The first quarter brought early signs of spring and mostly welcome economic news. A variety of leading indicators showed the U.S. economy, which not long ago was widely expected to slip into a recession, performed better than expected despite the dual pressures of higher interest rates and still-elevated inflation.

In 2023, as inflation began to cool, many investors expected the Federal Reserve to make early and aggressive cuts to its benchmark interest rate this year. Developments in the first quarter no doubt deflated their hopes, but not enough to derail stocks.

The economy’s resilience, expectations that the Fed will cut still rates (albeit more cautiously than some had hoped) and enthusiasm surrounding artificial intelligence pushed stocks to new highs. The S&P 500 gained more than 10%, its best start to the year since 2019. Just as importantly, we continued to see a healthier level of breadth as the bull market took a step closer to its two-year mark.

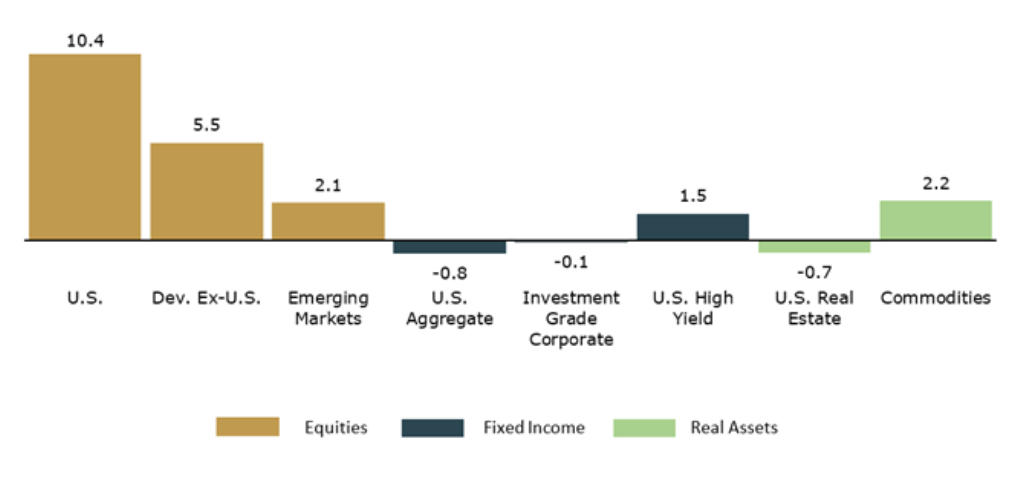

Q1 2024 Returns by Asset Class (%)

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Note: views are from a U.S. dollar perspective. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. Source: Kestra Investment Management with data from FactSet. Index proxies: Bloomberg U.S. AGG Bond Index, ICE BofA U.S. Corporate, ICE BofA U.S. High Yield, S&P 500, MSCI EM, MSCI World ex US Index, Dow Jones U.S. Select REIT, and Bloomberg Commodity Index. Data as of March 28, 2024.

Where do we go from here?

The Economy

While economic growth has remained resilient, the pain of high rates has begun to pressure some areas of the economy. Credit-card delinquencies, for instance, have ticked up as interest rates on accounts have risen to multi-decade highs.

The all-important job market continued its long stretch of growth in the first quarter, with payrolls notching their largest gain in more than a year in March. It’s worth noting that wage increases have been decelerating from the blistering rates of growth seen in the aftermath of the pandemic, a hopeful sign we will see less upward pressure on prices.

One of the most-notable developments of the first quarter was a fledgling rebound in manufacturing. Economic activity in the sector expanded in March after contracting for 16 consecutive months, according to the ISM Manufacturing Purchasing Managers Index.

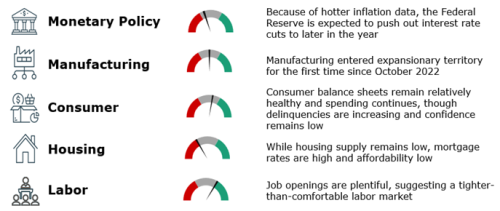

Economic Dashboard

Source: Kestra Investment Management

The Federal Reserve

Since policymakers began contemplating rate cuts last year, the central bank has

faced a much-discussed, two-sided risk: cut rates too slowly and risk causing

greater economic pain; cut rates too quickly and risk heating up the economy

and reigniting inflation.

Recent hotter-than-expected economic readings – from the surge in consumer prices to the blockbuster job gains in March – have given the Fed room to take a wait-and-see approach. “We can, and we will be, careful about this decision — because we can be,” Chairman Jerome Powell said in March. Given the strength of the economy, “we don’t need to be in a hurry to cut,” he added.

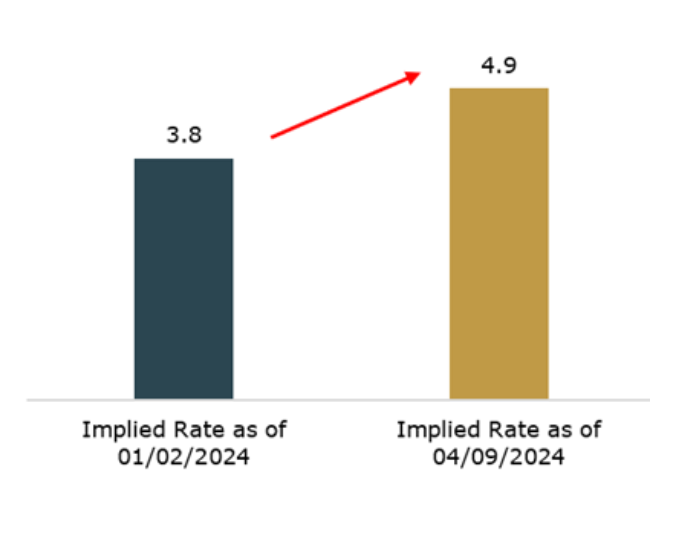

Since late 2023, market expectations for rate cuts this year have been dialed back significantly. At the end of December, the widely followed federal funds futures market was predicting that the Fed would cut rates a remarkable seven times, starting in March.

By early April, the market was forecasting roughly three rate cuts, with the first one pushed out to September.

It’s becoming increasingly likely that the central bank will leave its benchmark rate little changed, and at least one Fed official has floated the idea of rate increases. Going forward, we’ll need to see solid economic growth and corresponding increases in corporate earnings (the most-reliable driver of market returns) to underpin higher stock prices.

Implied Year-End Fed Funds Rate (%)

Source: Kestra Investment Management, based on Fed Funds Futures data from Bloomberg. Data as of April 15, 2024.

The Stock Market

In 2023, a handful of big tech companies (known as the Magnificent Seven) contributed the bulk of the S&P 500’s total return of more than 24%. This kind of sustained growth in a limited number of names is not unusual in the early stage of a new bull market.

Since late last year, though, this bull appears to be maturing as the broad market’s return has been driven by a larger and more-diverse group of companies in index, a trend we expect to continue. In the first quarter:

· All but one S&P 500 sector had positive returns. Only Real Estate, which is highly interest-rate sensitive, ended the quarter with negative returns.

· Higher oil prices fueled a rally in the Energy sector, which finished 2023 in the red.

· More-defensive areas of the market, such as Utilities and Consumer Staples, saw positive returns after underperforming last year.

· Mixed results among the Magnificent Seven grabbed headlines, leading Wall Street to coin a new term, Fab Four, to describe those in the group that outperformed the broader market.

Outside the concentrated, tech-heavy area of the market that drove early-stage returns, we see support for additional gains in terms of earnings and valuations. In the first quarter, the S&P 500 notched its third straight quarter of year-over-year earnings growth, according to recent estimates. For the full year, analysts expect S&P 500 earnings to grow by nearly 11% over the prior year, which, if correct, would be roughly equivalent to the index’s historical annual rate of growth for earnings.

Fixed Income

While stocks rallied in the first quarter, the returns among bonds were less impressive. Overall performance was slightly negative to flat, with the exception of high yield bonds, which increased nearly 2%.

Given today’s high yields, we continue to see opportunity in the bond market, with some caveats. If the Fed cuts rates this year, shorter-term yields are likely to decline, potentially reducing future returns for investors with heavy exposure to cash equivalents. What’s more, the recent surge in Treasury issuance may create volatility among longer-term bonds. In our view, the so-called belly (or middle) of the yield curve is better insulated from both these risks.

It’s also worth noting that we prefer high grade corporate bonds to high yield given the uptick in corporate bankruptcies, which hit a three-year high in 2023.

The Takeaway

The U.S. economy has shown remarkable resilience, and we expect it to continue to grow this year. That said, the inflation picture, the presidential election and geopolitical risks (namely the wars in Ukraine and Gaza) may contribute to the kind of market volatility we saw in earlier this month.

When it comes to the election, the good news is that its effect on the market is likely to be short-lived. Our analysis of long-range historical data shows that volatility tends to be higher during election years, but most of the time, the market ends the year on a high note.

The balance of this year may look a lot like the often-fitful transition from spring to summer – one day the sun shines, the next cold rain, followed by more sun. In fact, the Fed has warned that the path back to its target inflation rate of 2% may be bumpy. As always, a well-diversified portfolio can help investors ride out the inevitable dark days and stay focused on their long-term goals.

Invest wisely and live richly,

Kara

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The matrial is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. Does not offer tax or legal advice.