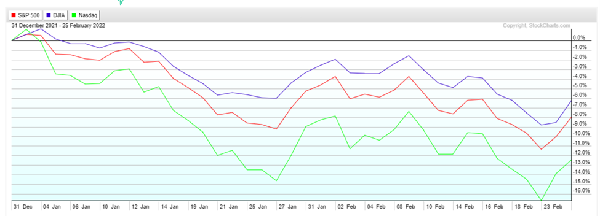

February ended with the specter of Russia invading Ukraine. The aggression is jarring, and the communications out of the Kremlin alarming. Ukrainian’s resolve has inspired much of the rest of the world to support Ukraine and oppose Russia. It is hard to judge how the conflict ends. Still, the economic repercussions appear to be another inflationary supply shock that adds another level of complexity to the Federal Reserve’s task of dampening inflation. Below is how February unfolded.

February 4, 2022: An eye-popping jobs report portrayed a much brighter picture of the U.S. labor market. 467,000 January job gains far exceeded economists’ expectations of a 125,000 gain. An encouraging data point was the labor participation rate surging to 62.2%, suggesting that workers are coming off the sidelines and returning to the workforce.

February 10, 2022: Readings of hotter than expected inflation hit the wires, with the U.S. inflation rate accelerating to a 40-Year high of 7.5%, levels not seen since 1982. Most had expected Omicron to dampen the economy; apparently, it did not. Stocks tumbled, with NASDAQ and high multiple stocks taking the brunt of the selling. The U.S. Treasury 10-year rate spiked to 2%, the first time since August 2019

As jobs and inflation reports came in higher than expected, the European Central Bank (ECB) fell in line with the U.S. Federal Reserve and acknowledged inflation as a problem they must confront.

Fed Chair Powell is scheduled to deliver a semi-annual monetary policy report to Congress (called the Humphrey Hawkins testimony) on Wednesday, March 2. This report and the ensuing Q&A session should provide insights into where the Fed is in raising rates and running off its balance sheet.

Stocks with longer duration cash flows continue to be more heavily influenced by rate moves than stocks with current cash flows. It is reflected both by stocks with the lowest valuations holding their ground better than expensive stocks and the Nasdaq selling off. This dynamic should continue as long as the Fed is in tightening mode.

We expect market turbulence as geopolitical events evolve and the Federal Reserve takes measures to dampen inflation. Bond returns will very likely continue to be challenged. We will stay focused on what we can control and remain committed to investment strategies informed by your financial plan and portfolios that are well-diversified, cost-effective, and tax conscious. Just like seasickness, keeping one’s eyes upon the (longer time) horizon can help alleviate the nausea caused by rough seas.

Thank you for the trust you placed in us! We look forward to connecting soon!