Executive Summary

- Thus far, 2022 has been an investment bust. Stocks and bonds have sold off together—the more speculative the asset, the bigger the declines. Crypto investors are certainly getting some hard lessons. The drawdown in cryptocurrencies exposes excess leverage, fraud episodes, and cyber security lapses. Investors are learning about excess leverage that has resulted in defaults and bankruptcies. You might check on your young people!

- The cause for drawdown? I would say the reversal of emergency pandemic fiscal and monetary policies. The economy was pumped full of cash, stoking demand while supply was constrained. A potent brew for inflation!

- The Federal Reserve is culpable for leaving emergency measures in place for too long. The Fed and the government didn’t get focused on inflation until it cost them both credibility and political favor. They ignored dissenters and economic history.

- The Fed’s late policy reversal and an uneven clearing of supply chains combined with post-pandemic changes in consumer preference whip-sawed markets. This created turbulence in supply and demand amounted to garbled signals about corporate earnings and consumer financial health.

- By the end of June, Fed tightening and jawboning combined with the natural order of economic dynamics have inflation rolling over. The economy is slowing but maybe still growing. Forward-looking investment markets have repriced to deep discounts. Market forces often overshoot, and I believe this time is no exception.

- Where do the stocks and bonds markets go from here? In the immediate term, it’s very likely to stay bumpy. However, for the second half of 2022, I expect stocks and bonds to recover.

The first half of 2022 was the worst start for the market in 50 years. Attached is a quarterly market review for the second quarter of 2022. You will see that both stocks and bonds sold off in the second quarter with June delivering another leg down for the equity markets. On June 10, the Bureau of Labor Statistics released a consumer price index (CPI) reading of 8.6%, a 40-year high. The same day, the University of Michigan consumer sentiment index registered the lowest reading since 1978, strongly indicating that inflation expectations were taking hold. When consumers believe inflation is not “transitory,” their behavior changes potentially making further, longer-lasting inflation a self-fulfilling prophecy.

Following the CPI and sentiments reports,

the Federal Reserve had a policy meeting on June 15. Though the Fed had set firm expectations for a 50-basis point increase in the federal funds rate, the Fed surprised the market with a 75-basis point increase. Initially, the market rallied, presumably because it wanted the Federal Reserve to rein in inflation. However, the June selloff regained momentum the following day as it sunk in that tighter policy translates to a slowing economy and, perhaps ultimately, recession.

In our 2022 market Outlook we stated, “In 2022, COVID will likely relinquish the newsfeed’s center stage to inflation, interest rates, and the Fed. The labor markets are tight, inflation is hotter than desired, and the Federal Reserve has kicked off a reversal in its accommodative monetary policy. Thus, the Fed will continue to play a significant role in the economy and investment markets throughout 2022.”

I may have understated the significance the Federal Reserve’s influence would have on markets in 2022. After leaving emergency monetary measures in place for too long, The Fed Chair issued a “mea culpa” that they had underestimated inflation’s severity and persistence. With credibility damaged, the Fed refocused on reining in inflation while an anxious market watches over its shoulder, increasing the likelihood of a policy mistake.

Inflation, the Fed, and the Bat Signal

For Batman, deterrence is a crucial tool to fight crime. Convincing criminals that the crime is not worth a Batman beat-down makes them think twice, especially when they see the bat signal! The Fed operates similarly with inflation expectations. Market participants will modify their behaviors if they believe the Fed is more committed to slowing inflation and is willing to accept the risk of causing a recession.

It is a delicate balance, and in the last couple of weeks of the second quarter, the Fed appears to have gone from being behind the inflation curve to having market participants believe the economy is headed for recession. Instead of the bat signal, the Federal Reserve uses various communication methods. The Fed issues press releases, economic projections, and meeting notes to set expectations about their policy path. They also conduct press meetings, give speeches, and interviews. In a short time, the Fed’s “jawboning” appears to have shifted the market’s current fixation from inflation to a recession. Successfully, convincing the market that it will lower inflation, even if it means they will beat down economic growth in the process. Fed jawboning may be one of the few exceptions to the saying, “actions speak louder than words.”

Fortunately, and contrary to what many pundits and politicians may lead you to believe, the Federal Government is not the economy’s only hope for taming inflation or avoiding a deep or protracted recession. The ability of market participants to continually process new information and adjust their behavior in their best interest is a much greater force than many appreciate.

As an example, consider the adage “the solution for higher prices is higher prices”. Though it may sound overly simplistic, there is great truth to it. Higher prices price some buyers out of the market, and higher prices incentivize suppliers to supply more. In a free market, this is the continuous process by which participants discover an equilibrium price.

The good news is that, regardless of the causation, there is growing evidence that inflation has peaked. Market-based measures known as Break-even Inflation Rates have rolled over, indicating the market believes inflation will be at or lower than the Fed projects two-plus years out. Also, commodity prices have recently weakened, and in the face of a recession, oil prices declined in anticipation of lower demand from slower economic activity.

Investor expectations tend to have a recency bias; therefore, it is understandable that they may be overly pessimistic when the three pre-pandemic recessions were doozies. All three were credit crisis-induced recessions (1) commercial real estate (aka S&L Crises), (2) telecom, technology (aka dot.com bust), and (3) residential real estate (aka Great Financial Crisis) that drove the three most significant post-WWII earnings declines.

Investor expectations tend to have a recency bias; therefore, it is understandable that they may be overly pessimistic when the three pre-pandemic recessions were doozies. All three were credit crisis-induced recessions (1) commercial real estate (aka S&L Crises), (2) telecom, technology (aka dot.com bust), and (3) residential real estate (aka Great Financial Crisis) that drove the three most significant post-WWII earnings declines.

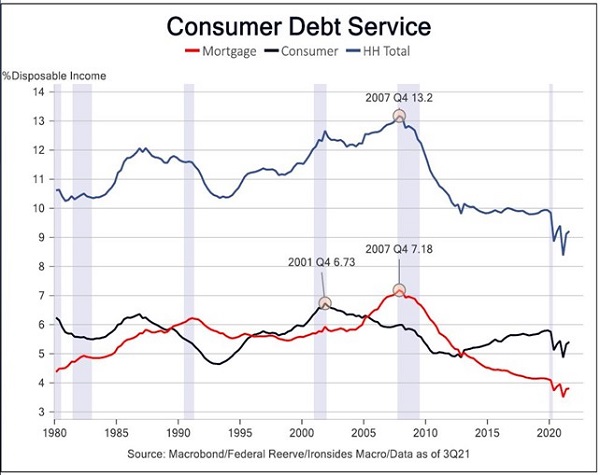

However, today’s circumstances differ significantly from the three recent credit-induced episodes cited above; our financial institutions, corporations, and consumers are in much better shape. Most took advantage of the extraordinarily low rates over the past few years to recapitalize. The chart below provided by Ironsides Macroeconomics illustrates how consumer debt service as a percentage of income has decreased. This probably does not surprise you. You and most everyone else you know refinanced, right? Corporations took advantage of the low rates too by issuing bonds and taking loans.

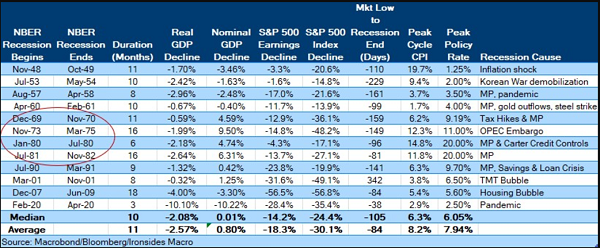

The table below accompanied a recent commentary from Ironsides Macroeconomics. It details the cause and economic impact of post-WWII recessions. The punchline? Recessions caused by monetary policy intended to stem inflation have impacted corporate earnings less than the more severe recessions associated with credit crises. The author, Barry Knapp, concludes by using this history to benchmark the current widely anticipated recession relative to its market decline. In his words, “Consequently, a significant earnings decline is very unlikely, implying the decline in stock prices has overshot the most probable outcome and adequately priced the worst-case scenario.”

As of July 8, 2022, the Labor Department reported better than expected jobs data with wages stabilizing. Jobs growth as measured by nonfarm payrolls grew 372,000 while estimates had come in around 250,000. Headline unemployment remained at 3.6%, but the unemployment index, including discouraged and part-time workers, dropped from 7.1% to 6.7%. Wages appear to be holding up as well. This report does not support the “we are already in, or will soon be, a recession” narrative and should reassure those fearing the economy is stalling into a recession.

In a recent commentary, Professor Jeremy Siegel summarized his outlook for recession: “If our economy is officially in a recession, it will be one of the strangest recessions I’ve witnessed with record-low unemployment rates. Jobless claims remain very low; the labor market is the only market that remains strong, and services with high labor constraints will be the one remaining key impulse for inflation.”

Maybe the economy has enough growth as the wind under its wings for the Fed to bring the economy in for a “good”, but not necessarily a “soft”, landing.

As investors, we must always expect and cope with uncertainty. When a recession occurs, its severity and duration are uncertain. While such periods can be intense, investors who learn to embrace uncertainty may often triumph in the long run. Conversely, reacting to down markets is often a recipe to derail your progress toward reaching financial goals.

A recession is not a reason to sell. We may be headed for a recession or already in one. The stock market is a leading indicator of the economy, which tends to fall before recessions and recover before the economy regains its footing. We believe the only good reason to sell out of a diversified portfolio is if your risk tolerance or investment goals have changed.

Don’t assume a short-term drawdown of your financial accounts will knock your retirement plan off track. Instead, let us revisit your financial plan and review your portfolio with you. Doing so can help you reframe your unique personal financial goals and circumstances into a long-term view. It is the best way to assess the impact of market changes upon achieving your goals and provides a framework to consider corrective actions if warranted.

I believe today’s lower stock valuations represent the opportunity for higher future returns on your investment. If you have investable cash, consider gradually committing it to long-term investments. Other appropriate actions may be to consider maxing out retirement plan contributions or doing a Roth conversion.

We are reviewing portfolios and rebalancing to lean into the investment types and sectors we believe are best suited for the economic and market situation as it stands today. In addition, for taxable accounts, we are looking for opportunities to harvest losses as we reposition.

We are here to help! If you would like to discuss the state of the economy and markets or review your financial plan and portfolio, I encourage you to schedule a virtual or in-person meeting. My mobile phone number is 817-271-0654, and you are welcome to call after hours if that works better for you.

Thank you for your continued trust and confidence!

Tim

_________________________________________________________________________

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward-looking and should not be viewed as an indication of future results.

Converting a traditional IRA to a ROTH IRA is a taxable event and could result in additional impacts to your personal tax situation, including the taxation of current social security benefit payments. Be sure to consult with a qualified tax advisor before making any decisions regarding their IRA.