Throughout April, Russia became mired in Ukraine, and as horrible as it is, this conflict could drag on for some time. Inflation data continued to come in hot, and the Federal Reserve’s hawkish pivot broadened to include all committee members forming a united front for more drastic tightening. Based on Fed speak a few short months ago, it would have been difficult to conceive a unified Fed ready to tighten aggressively. The market correction and volatility experienced in April should not surprise as, historically, fed policy reversals have caused market turbulence. After injecting massive stimulus into the economy, the Fed has fallen behind the curve on inflation; it must now catch up to an economy that has absorbed multiple inflationary shocks.

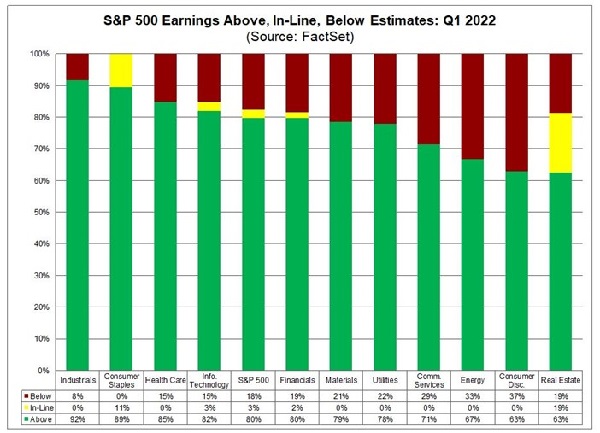

April’s Q1 corporate earnings reports have significantly varied between companies and sectors. But as reported by FactSet, with 55% of S&P 500 companies having reported through April 29, 2022, “the percentage of S&P 500 companies beating EPS estimates is above the five-year average, but the magnitude of these positive surprises is below the five-year average.“ So, in the aggregate and compared to 5-year trailing averages, reported earnings are beating estimates more than average but by a lower margin than average. Earnings reports to date support the notion that the economy is still growing, albeit at a slower pace.

Anecdotally, many companies provided weak, or chose not to provide, guidance, citing the uncertainty of inflation, Fed policy triggering a recession, the Ukraine conflict, and lingering supply chain issues.

Anecdotally, many companies provided weak, or chose not to provide, guidance, citing the uncertainty of inflation, Fed policy triggering a recession, the Ukraine conflict, and lingering supply chain issues.

A notable exception to the general trend of reported earnings beating estimates was Amazon (AMZN). On the final business day of April, Amazon surprised investors with a large loss and issued weak guidance, AMZN sunk over 14%, leading the way down for the NASDAQ and the broader market. Apple reported solid results on Friday but forecasted up to an $8 billion hit to revenue in the second quarter due to supply constraints attributable to Covid shutdowns in China.

By the end of April, the NASDAQ suffered its fourth straight weekly decline and slumped 13.2% for the month. On a year-to-date basis, the NASDAQ is down 21.2% (technically a bear market), The S&P 500 is down 13.3%, and Dow Jones Industrials are down 9.2% year to date through April 29.

Throughout April, the Fed continued its hawkish pivot, and the market continued to be unsettled.

In early April, Federal Reserve Governor Lael Brainard, who typically favors loose policy and low rates, said the central bank needs to act quickly and aggressively to drive down inflation—telegraphing what the Fed’s March meeting notes would likely reveal. The following day (April 6), the Fed meeting notes divulged the Fed’s plan for reducing its balance sheet, of which some variation will likely be adopted at the Fed’s FOMC May meeting. The notes relay a plan to reach a balance sheet runoff rate capped at $95 billion per month in three months. The targeted amount comprises $65 billion of treasuries and $35 billion in mortgages. This represents a more aggressive quantitative tightening (QT) than previous, similar events.

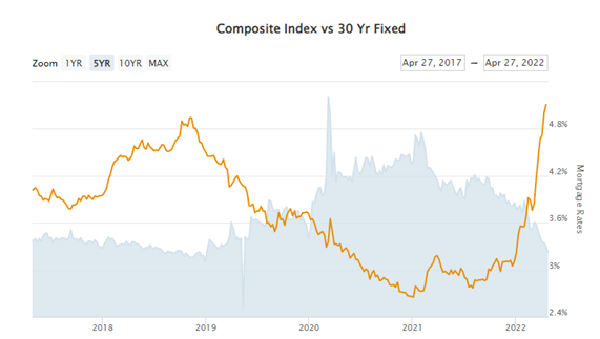

However, there is a hitch in the Fed’s mortgage runoff strategy. The mortgages held by the Fed are at rates lower than prevailing mortgage rates, which recently increased to 5.37% on conforming loans. People who hold mortgages will not refinance because lower rates are not available. Therefore, the only mortgages available for runoff are from home sales (the mortgage gets repaid) and equity-out refinancing. This level of runoff will very likely not hit the Fed’s target for reducing its mortgage holdings, and therefore, the Fed will have to decide whether or not to become a seller of mortgage-backed securities.

The Fed becoming a seller of mortgages will raise mortgage rates further and cool the housing market, a significant contributor to inflation. Total mortgage applications have fallen, as illustrated in the chart below. The line and right scale charts mortgage rates, and the gray area is the composite of all mortgage applications. Digging further into the data from April 26th, refinance applications have declined much more than purchase applications.

The Fed meets this week. The market expects a 50 basis point increase to the fed funds rate, and Fed watchers will be parsing the Fed’s plan for reducing its balance sheet.

Underlying Strength of Economy

Many clients have asked about an impending recession. Yes, the economy is slowing, but it is still growing. Despite the angst over inflation and Fed policy, other economic data portrays underlying strength, which belies the notion of a near-term recession. Of the corporations that have reported, many are still growing earnings, have strong balance sheets, are investing capital, and are hiring workers. The consumer is strong.

Jobs are plentiful, and unemployment is low. Higher wages are drawing workers back into the labor force. Supply chain disruptions appear to be easing, and companies are rebuilding their inventories. Financially healthy corporations and consumers do not support a recession thesis. Yes, the Fed may overtighten to the point of tipping the economy into recession. But for now, the Fed is in the early stages of fighting inflation, and the economy continues to grow.

With the Fed closer to the beginning than then end of its tightening cycle and war continuing in Ukraine, we expect more volatility ahead. Lower stock prices and higher earnings mean valuations look more attractive as well. We are looking for opportunities to selectively put money to work in this market environment.

Finally, the Berkshire Hathaway annual shareholder meeting was this past Saturday. I’ve attended the event over the years and CNBC was streaming it live online. Watching Buffett (age 91) and h

Finally, the Berkshire Hathaway annual shareholder meeting was this past Saturday. I’ve attended the event over the years and CNBC was streaming it live online. Watching Buffett (age 91) and h

is sidekick Charlie Munger (age 98) hold court, make arcane references and laugh at each other’s jokes, I couldn’t help but think of Statler and Waldorf, the two old fellows from the balcony on the Muppet show. But Buffet and Munger have shared many pearls of wisdom over the decades. One that I believe is especially relevant now is, “we simply attempt to be fearful when others are greedy and be greedy only when others are fearful.”

Despite the short-term volatility and the risk detailed above, stocks and bonds can provide attractive returns to those with a long-term mindset. Volatile times make it even more important that your portfolio is aligned with your goals, so please talk to us if you’ve any concerns.

Your April month-end portfolio reports have been deposited in your eMoney vault, and we are reaching out to offer review meetings. If you want to schedule a review sooner, please get in touch with us with dates and times that work well for you, or you may self-schedule here.

Many Thanks,

Tim